- #TURBOTAX FOR S CORP 2015 HOW TO#

- #TURBOTAX FOR S CORP 2015 DRIVERS#

- #TURBOTAX FOR S CORP 2015 FULL#

- #TURBOTAX FOR S CORP 2015 SOFTWARE#

Contact Us for Tax Preparation Help Today!

#TURBOTAX FOR S CORP 2015 HOW TO#

Working with an experienced CPA is recommended if you’re not sure how to break up the costs. Anything besides this is considered personal, and thus, ineligible. It’s important to note you can only deduct the portion of the fee related to preparing the business side of your taxes, such as Schedule C, E, or F.

#TURBOTAX FOR S CORP 2015 SOFTWARE#

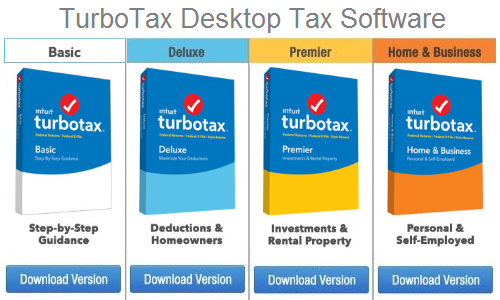

Tax preparation software you use yourself, like Turbotax.If you are a business owner or independent contractor and are eligible to deduct your tax preparation fees, you can deduct: If you aren’t sure if these apply to you, it’s important to consult with an experienced tax professional to help you avoid fines and fees. Freelance workers, such as graphic designers.

#TURBOTAX FOR S CORP 2015 FULL#

#TURBOTAX FOR S CORP 2015 DRIVERS#

Deducting Tax Preparation Fees as a Business Expense However, this only affects personal taxes, and business owners can still use this deduction as a business expense.

While it did increase the standard deduction by a significant amount, it eliminated many of the individual, line-item deductions, including the deduction for personal tax preparation. In 2017, the Tax Cuts and Jobs Act (TCJA) was passed and signed into law, which led to an overhaul of the United States tax code. For example, you could deduct the cost to prepare 2015’s taxes from the return you file in 2016. If you feel that has changed, you’re correct up until 2017, anyone could deduct the previous year’s tax preparation costs from their taxes. Today, if you are a W-2 employee, you can not deduct any costs or charges for preparing your tax return if you file a standard deduction (which is a majority of people). Our CPAs are sharing a more in-depth look at who can deduct the cost of preparing their taxes and how changes in the tax code may affect you. In some cases, you can deduct tax preparation fees and costs on your taxes, but not everyone is eligible for this deduction. You may choose to do your own taxes using tax preparation software, or you may choose the more stress free route and work with a CPA firm in Raleigh. With April 15th rapidly approaching, you’re probably in the midst of gathering receipts and records, looking for ways to minimize your tax burden, and debating how your taxes will get done.

0 kommentar(er)

0 kommentar(er)